Get Instant Access to The NEW Fundability System™ With Coaching Now …

Choose your plan below to get started

8 MONTHLY PAYMENTS

Easy Monthly payments

$497/Month

- FUNDABILITY CHECKS™

- BUSINESS CREDIT BUILDER

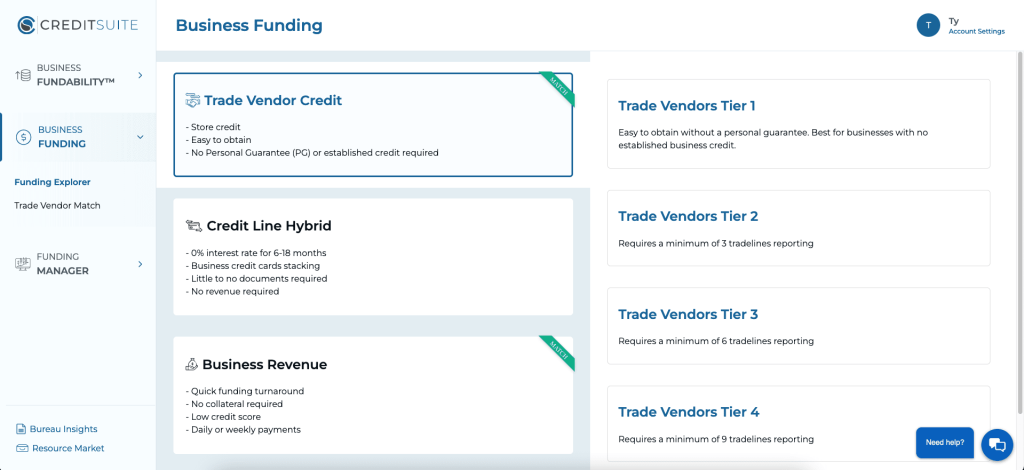

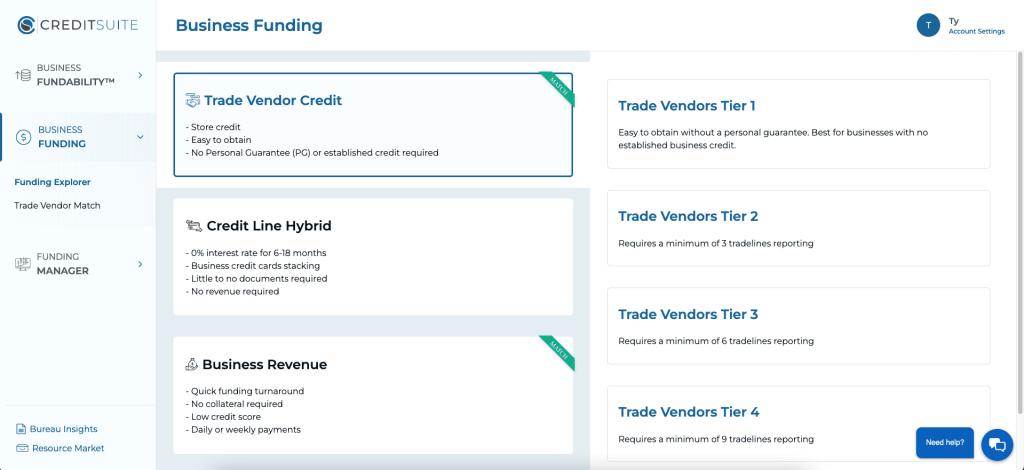

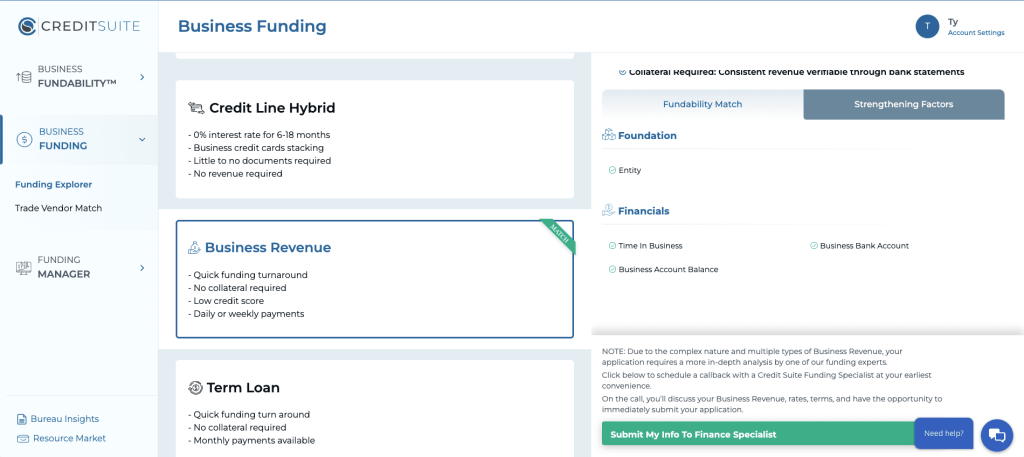

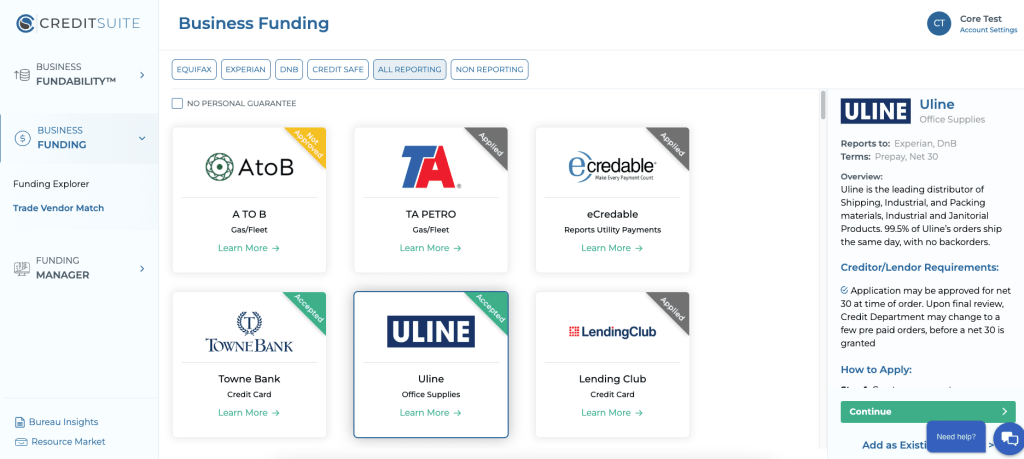

- FUNDING EXPLORER

- UNLIMITED COACHING

- FINANCING SPECIALIST ACCESS

- CASH FLOW MONITORING (COMING SOON)

- BUREAU INSIGHT™ ACCESS (COMING SOON)

SINGLE PAYMENT

SAVE MORE

$2,997

SAVE 50%

- FUNDABILITY CHECKS™

- BUSINESS CREDIT BUILDER

- FUNDING EXPLORER

- UNLIMITED COACHING

- FINANCING SPECIALIST ACCESS

- CASH FLOW MONITORING (COMING SOON)

- BUREAU INSIGHT™ ACCESS (COMING SOON)

Buy Now Pay Later with Credit Key***

* Subject to credit approval.

**Reports Payments to Dun & Bradstreet

Featured In

Access The New & Improved Fundability System™

The Fundability System is the first of its kind—the one and only Fundability™ and Financing software that exists on the market today.

Our new, interactive Fundability System™ adapts to each and every business owner and their unique situation, responding intuitively to the answers you provide, generating a step-by-step, personalized funding plan to quickly build your business credit, apply for financing, and get approved for hundreds of thousands in business credit and loans … all in one place.

Through Fundability™, we give business owners like you the opportunity to SUCCEED in building their dream, growing their business, and having a real chance at lasting success.

funding and credit they need for their business.

Plus … It works even if you’ve been in business for years or you’re just getting started.

Here's Exactly What You Get In The Fundability System™

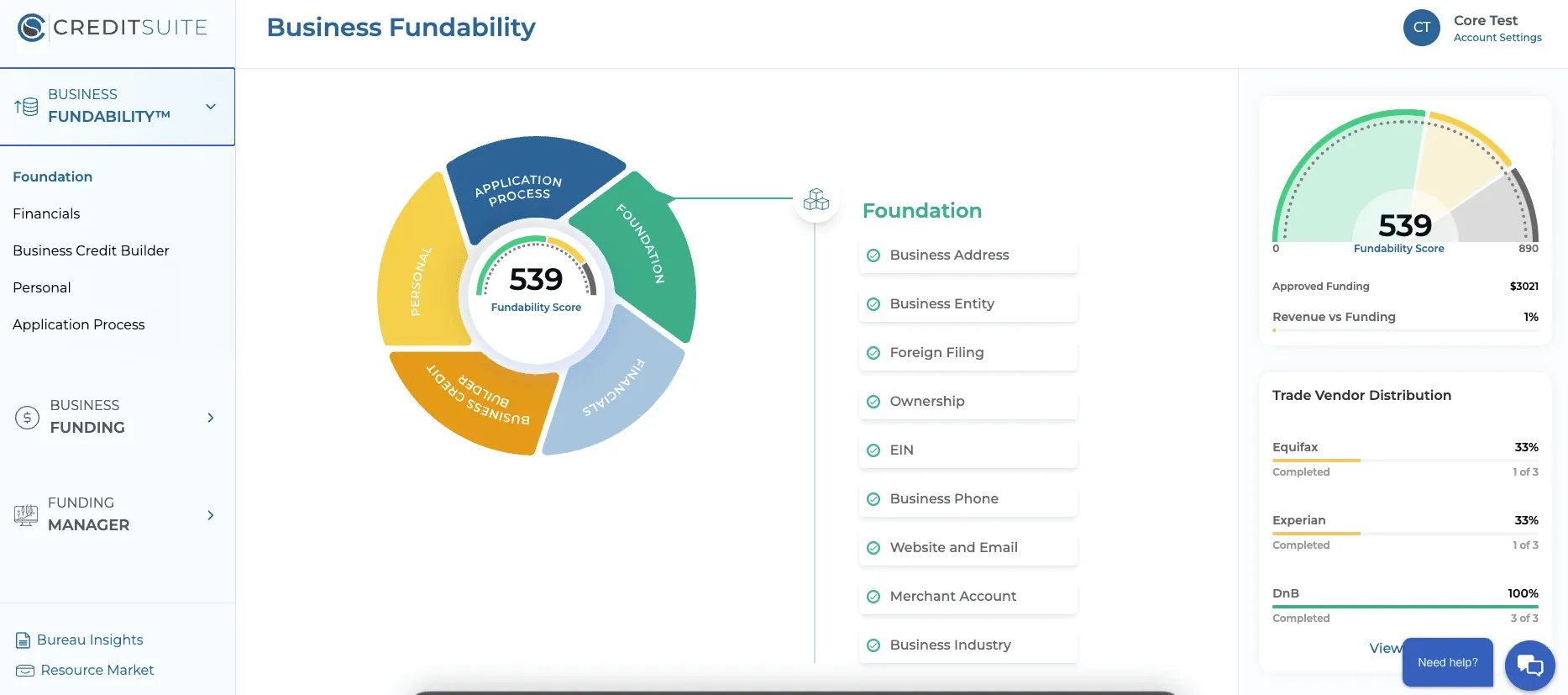

BUSINESS FUNDABILITY

- National & Local Business Listings

- EIN and Entity Setup Assistance

- Business Industry Fundability Check

- Business Address Fundability Check

- Business Phone Fundability Check

- Website & Email Fundability Check

- Bank & Merchant Account Setup Assistance

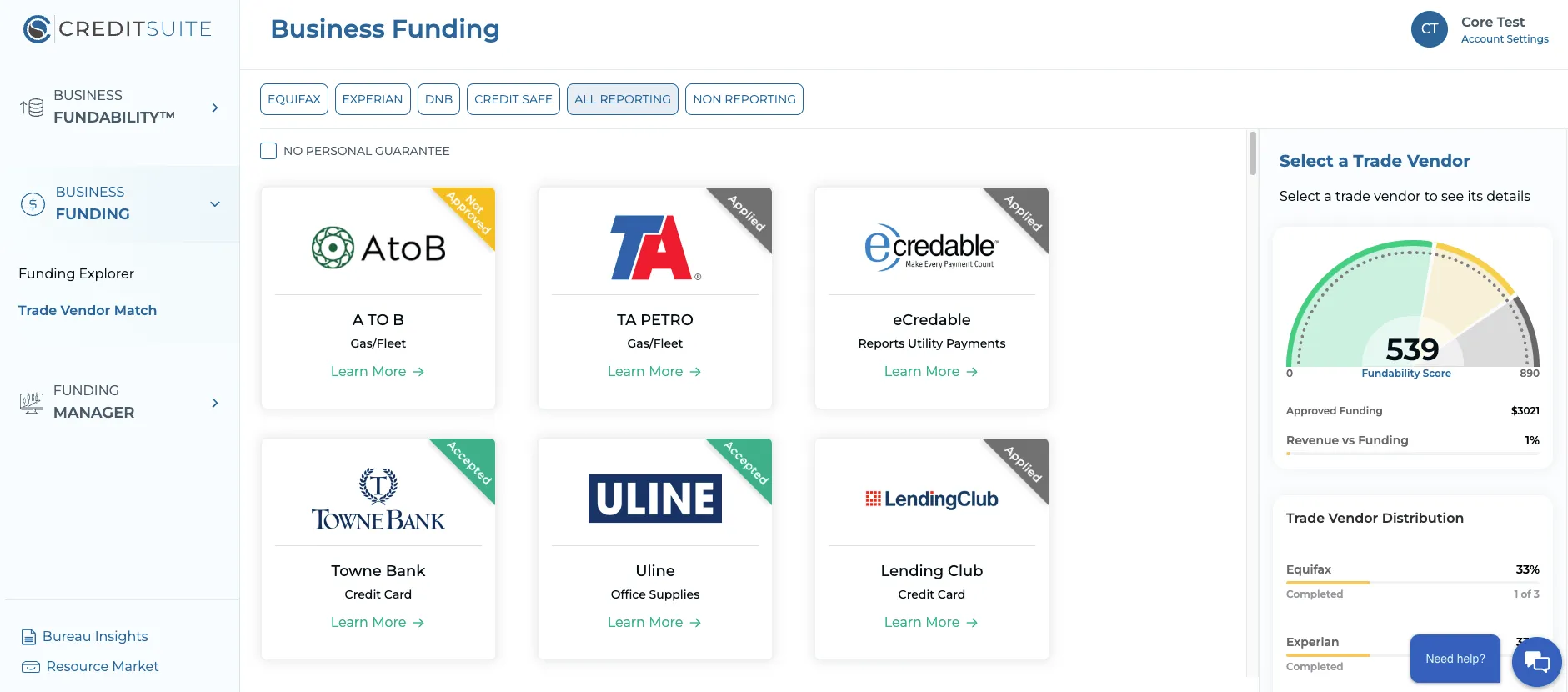

BUSINESS FUNDING SOLUTIONS

- Dispute Damaged Business Credit

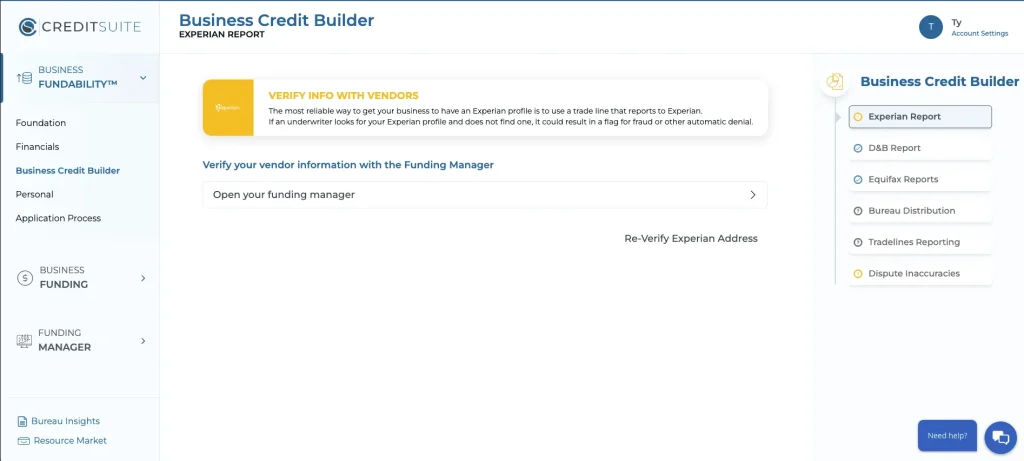

- Business Credit Reports & Score Training

- Get Setup with D&B, Experian & Equifax

- Largest Curated Selection of Vendors

- Largest Selection of High-Limit Retail Credit

- Access High-Limit Fleet Credit

- Access High-Limit Business Credit Cards

- Access Auto Vehicle Financing with No PG

- Unsecured, No-Doc, 0% Financing

- Get Loans with Rates of 5% and Less

- Access Accounts With or Without a PG

- Prequalified Matched Accounts

FINANCE AND ADVISOR SUPPORT

- Full Mobile Access

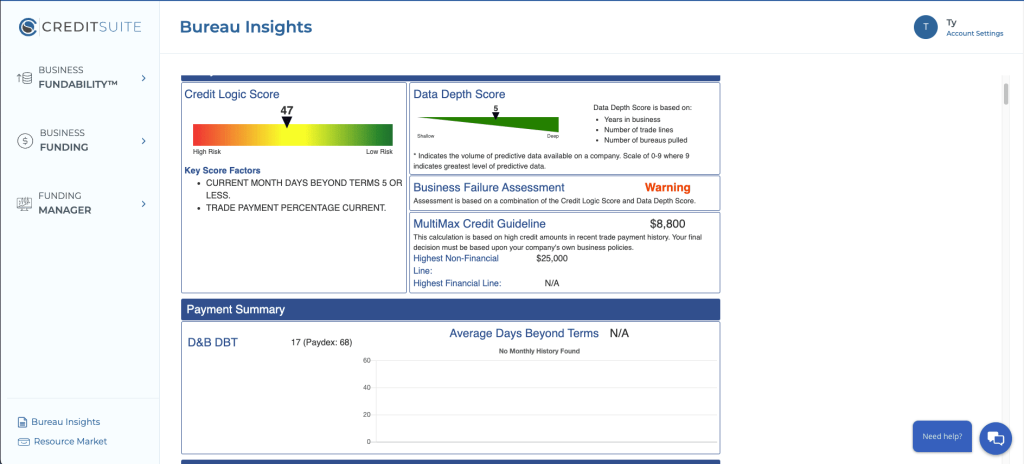

- Get Business Bureau Insights & Scores Every 30 Days(additional purchase)

- Secure Business Loans within 72 Hours

- Finance Specialist Support

- Get Loans with Record-Low Rates

- Cash Flow Monitoring (coming Soon)

- LexisNexis Report

- ChexSystems Report

Get Started Now

The Fundability System™ is a total replacement of the way business credit building and business lending have always been done.

Fundability™ is the fastest and easiest way you can ensure your business has ON-DEMAND access to loans, lines of credit, business credit cards and vendor accounts for the life of your business.

When you join, you’ll receive exclusive access to industry-leading Fundability™ technology to help you with all aspects of improving your Fundability, building your business credit, and getting loans and credit lines … so your business can THRIVE year after year, recession or not.

PLUS … you’re helped through the process step by step with your own Business Credit Advisors and Finance Specialists.

What Business Credit and Business Funding Is Really About … It’s More Than Just Money … Much More …

Business credit and business funding means you can get money to:

- Grow an existing business

- Start a business

- Hire employees

- Get new equipment

- Open new locations

- Get vehicles, fuel and maintenance

- Advertise to get new clients and customers

There are hundreds of reasons to get business credit and business financing. But here’s what business credit and business financing is really about.

It’s about your goals … your future … your prosperity and being able to look after those you care about the most.

Who does this work for?

If you’re worried that you won’t know how to do it or that it won’t work for you? Relax. Our program is for anyone who wants to be (or already is) a business owner…

If you’re

- A startup

- Solopreneur

- Small business

- Have been in business for years

- Have been denied for credit and funding before

- Have no (or even some) established business credit

- Have tried building business credit and failed

The Fundability System™ can work for you.

Plus … we provide you with instant access to powerful resources you’ll need to be successful including: the option to add Concierge Coaching to your Fundability System™. That’s right … get UNLIMITED comprehensive, one-on-one coaching with our Business Credit Advisors and Finance Specialists, even access to ongoing tech support all for only $197/month.

7 Reasons Why Fundability™ Is Absolutely CRUCIAL For

Running and Growing A Successful Business…

1

The NEW (And Fastest) Way to Build Business Credit

you through the business credit building process painfully step by step. Simply input your business’s information and gain complete access to the key Fundability Factors that unlock UNLIMITED funding opportunities every time you increase your business Fundability.

2

Get UNLIMITED Access to Funding

Funding a business with one loan or one credit card is nearly impossible. Any successful business owner in pursuit of growth, sustainability, and longevity will need ongoing access to capital for the life of their business.

3

Stop Constant Denials

means having the power to access business credit and business financing at any point in your business journey … especially when you need it most.

4

Build Business Credit & Access Financing All In One Place

Most companies in this space only offer business credit building or business financing alone—not both. For the ones that do, access to funding is limited. Whereas most lenders and brokers only offer 1, 2, or 3 funding programs, Credit Suite offers HUNDREDS of vendors and creditors to choose from to start or grow your business.

5

Save Thousands & Years Building Business Credit

When you build business credit on your own, it can cost you THOUSANDS and take YEARS with little-to-no-results guaranteed. Our unique Fundability System takes years of business credit building and condenses it down to ONLY months.

6

Access More Money At The Best Terms & Lowest Rates

for greater peace of mind with every application approved. Plus … you’ll save you hundreds,

even thousands in interest, year after year.

7

Empower Your Business to Fund Itself

longer risking your retirement, dissolving all chances of buying a home, or getting so buried in personal debt that you can’t manage to cover unforeseen life events.

8

Unlimited Coaching

lines they’re looking for is because they get stuck… Having experienced business credit coaches at your fingertips can keep the process moving even when it feels stuck. Your enrollment comes with unlimited coaching during business hours. They’re just a phone call away.

Here’s Everything You Get With The New

Fundability System™

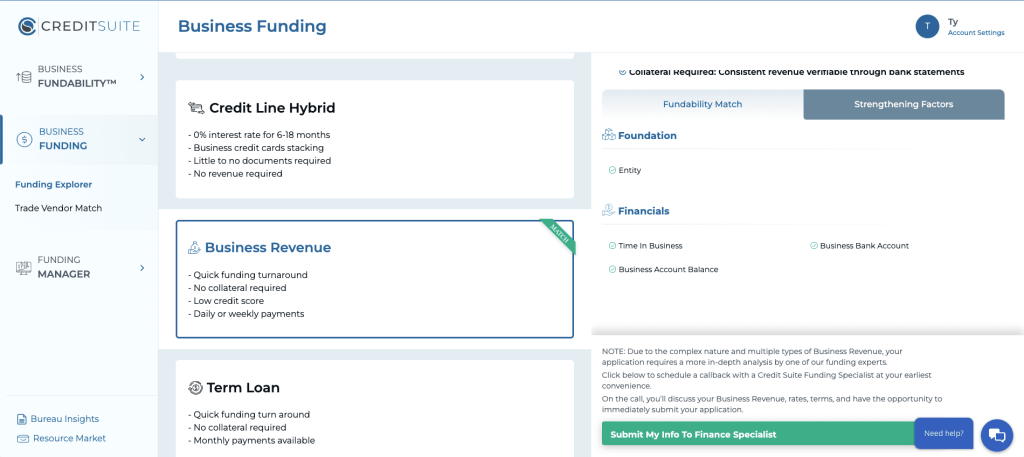

Exclusive Access to The Funding Explorer

Our Funding Explorer contains one of the largest selections of business credit accounts and lending options available today. It also provides personalized recommendations for strengthening your Fundability and building your business credit step by step. Personalized recommendations help you to know which types of financing you currently match with now and what Fundability Factors you need to work on to qualify for more Fundability Matches™ with better terms, lower rates, and faster approval times.

Access Top Rated Funding Programs

- Credit Line Hybrid/Business Credit Cards

- Business Revenue Lending

- Term Loans

- Lines of Credit

- Accounts Receivable Financing

- Purchase Order Financing

- Equipment Financing

- Collateral Financing

- Retirement Account Financing

- Industry Specific Financing

- Vehicle Financing

- Securities

- SBA Loans

- Real Estate

- Book of Business - Insurance Business

- And More!

Get HUNDREDS of Credit Options:

- Starter Vender Credit

- Store Credit

- Service Credit

- Retail Credit

- Business Credit Cards - Mastercard/Visa

- Fleet Credit

- Company Vehicles

Get Matched With Accounts You Prequalify For

Easily determine the accounts you qualify for now with our Fundability Match™ accounts located in your Funding Explorer. As you build your credit and increase your Fundability, more and more funding opportunities will open up, giving you unprecedented access to high-limit revolving accounts. This feature expedites business credit building and eliminates the guesswork of what to apply for, while also increasing overall approvals.

Unlock Essential Criteria for Approval

Every vendor and revolving account listed in your Funding Explorer displays a complete set of details that make it easy to apply and get approved; including a description of the products and services each vendor sells, access to all account terms, the reporting agencies each account reports to, and a direct link to apply with or without a personal guarantee.

Ensure Your Business Credit Building Success With The Most Up-to-Date Funding Criteria

Our team works around the clock to vet thousands of creditors and lenders and keep their information up-to-date on a monthly basis, so you never have to question if a company still reports, if the underwriting criteria is no longer valid, if the rates and terms have changed, or what you need to do to get approved successfully.

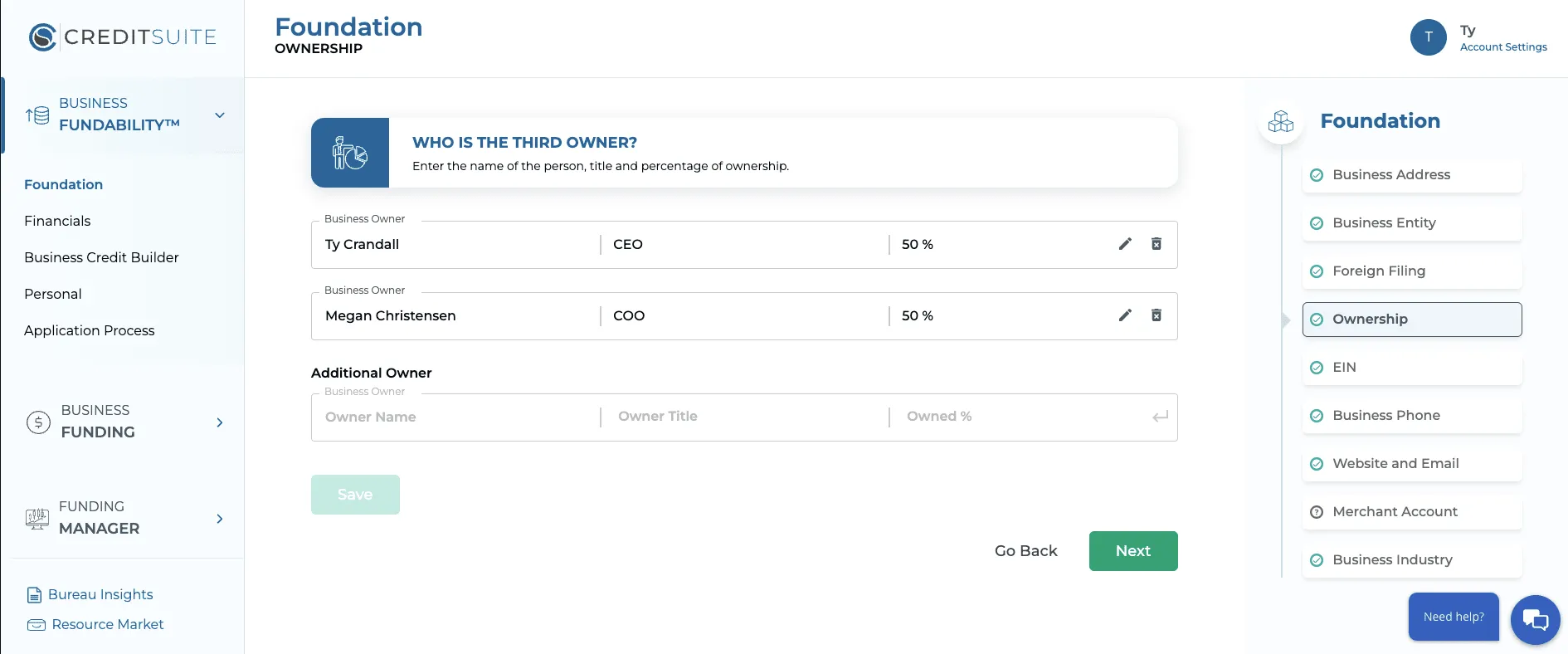

Ensure Business Credit Success With Our Business Info Aide

The #1 frustration business owners have is that their accounts won’t report. We help business owners easily fix this by capturing all business information in the Business Info Aide, so that business owners can simply copy and paste their correct information into all applications. Getting this wrong adds MONTHS to the process. Getting this right dramatically speeds up your business credit building AND your ability to get approved for more money much faster.

Download Bureau Insights & Scores Every 30 Days

With our complete Bureau Integration, you get full access to the same Bureau Insights lenders and creditors use. PLUS … you can now instantly download your D&B, Experian, and Equifax reports and scores EVERY 30 DAYS to verify your accounts are accurately reporting and your business credit is booming … saving you time, money, and the added frustration of sitting on hold with countless customer service reps every time you have a question about your credit report.

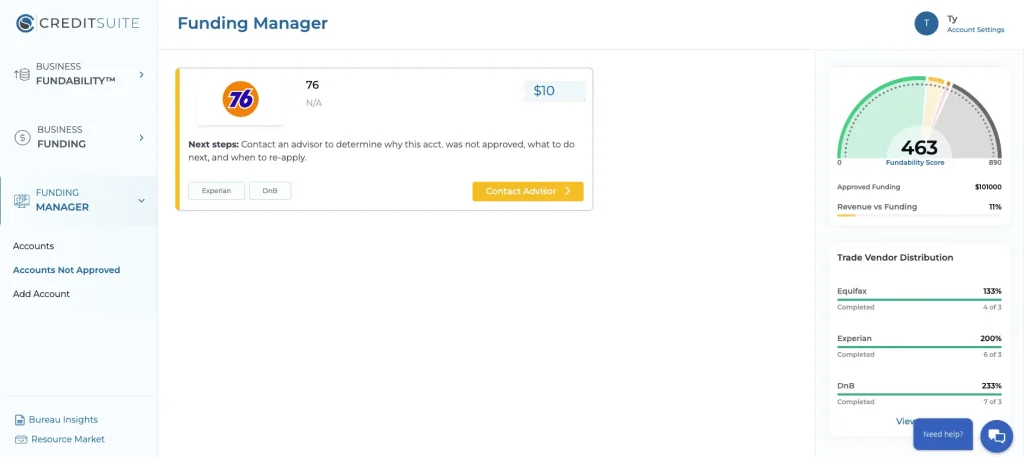

Declined Account Assistance

Many types of financing are reviewed by the same underwriters, so if you’ve been denied for one account, you will likely be denied for others within the same network. If you have your heart set on a specific account, we’ll help you get it.

Track All Your Accounts All In One Place

There’s so much information to track on business reports that the process can become very messy very quickly, causing business owners to lose sight of building business credit altogether. And with too many factors to track, it’s hard to know exactly what you should pay attention to MOST. We’ve identified critical key areas to track so you can zero-in-on what’s most important for building your business credit quickly.

The Largest Vault of REPORTING & Non-Reporting Accounts

Reporting vendors are absolutely crucial to building your business credit. Plus … these vendors are verified by our own team of advisors every 30 days to ensure they report to at least one of the main business bureaus, helping you to build a strong business credit profile and score with total confidence and less stress.

Get More Financing

Adding even one business owner or additional credit partner into your FS can increase your funding opportunities and credit limits substantially, allowing you to prequalify for even more financing. Add a new business owner or credit partner at any time to unlock more funding options to move your business forward with solid confidence and greater peace of mind.

Raise Your Fundability Score

The Fundability Score is an indicator of where you are now, an expression of the overall health of your business’s Fundability, and it shows how likely it is that you’ll get funding with a lender or creditor today.

The Most Up-to-Date Platform

There’s so many different financing options and business credit building “gurus” out there … and nobody really knows what’s up to date, where the criteria is coming from, or even if the information is valid. One of the biggest benefits of our new Fundability System is that there’s no need to do endless Google searching – you can find what your business actually qualifies for, in addition to the most up-to-date business credit building requirements backed by current market research and nationally recognized business lending institutions that we partner with firsthand every day.

PLUS! YOU EVEN GET ACCESS TO A FULL-SCALE BUSINESS

MARKETPLACE

many instances, we’ve even secured some form of discount or bonus with these excellent companies

… only for members of the CREDIT SUITE PRIME program.

Marketplace Essentials You’ll Have Access to:

Accounting

CRM

Email Marketing

Web Design

Payroll

Surveys

Software

Merchant Services

Contractors

Resources

Bureau

Financial Institutions

Marketing

Virtual Offices

Phone Systems

You Can Even Access UNLIMITED Advisor Support!

support—to help guide you through the Fundability process, bypass potential roadblocks, and

expedite your business credit and loan approvals.

Choose your plan below to get started

8 MONTHLY PAYMENTS

Easy Monthly payments

$497/Month

- FUNDABILITY CHECKS™

- BUSINESS CREDIT BUILDER

- FUNDING EXPLORER

- FINANCING SPECIALIST ACCESS

- BUREAU INSIGHT™ ACCESS (COMING SOON)

SINGLE PAYMENT

SAVE MORE

$2,997

SAVE 50%

- FUNDABILITY CHECKS™

- BUSINESS CREDIT BUILDER

- FUNDING EXPLORER

- FINANCING SPECIALIST ACCESS

- BUREAU INSIGHT™ ACCESS (COMING SOON)